Key Takeaways

- Recruitment capacity determines your hiring team’s realistic output within a set timeframe and directly influences your ability to meet strategic objectives.

- The cost per hire represents the total investment required to bring new talent on board, encompassing both internal operations and external expenses.

- Data-driven models, when integrated with qualitative insights from your organization, dramatically enhance the forecasting accuracy and ROI of your talent acquisition strategy.

Table of Contents

- Understanding Recruitment Capacity

- Calculating Cost Per Hire

- Data-Driven Forecasting Models

- Best Practices for Accurate Forecasting

- Common Challenges and Solutions

- Conclusion

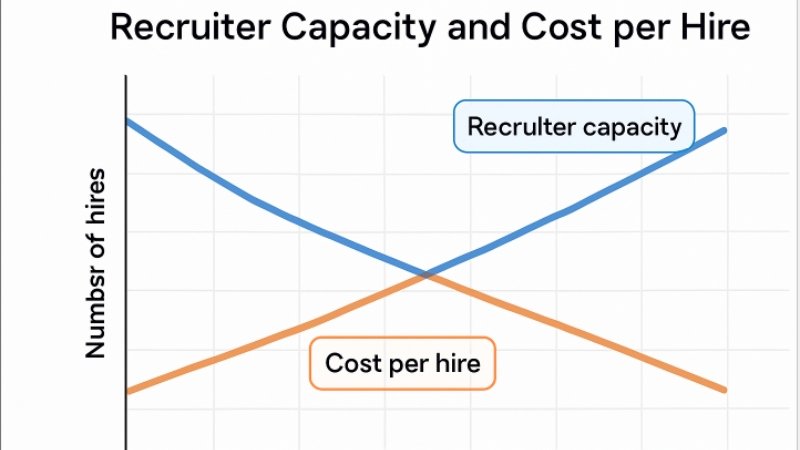

Building an effective recruiting strategy hinges on accurately forecasting both recruitment capacity and the cost per hire. By making informed decisions based on capacity models, organizations can ensure consistent hiring results, better budget control, and agile adaptation to changing talent needs. Leveraging actionable frameworks—like a recruiter capacity model—empowers HR leaders to proactively plan headcount and recruitment investments, ultimately strengthening the entire talent acquisition function.

Poor forecasting or misunderstanding the total cost implications of hiring can result in missed targets, stretched teams, and excessive spending. Successful recruitment planning requires organizations to synchronize recruiter output, market dynamics, and historical hiring data, so hiring managers and recruiters are united around achievable goals. Mastering these skills saves resources, maintains engagement with candidates, and supports ongoing business growth.

Understanding Recruitment Capacity

Recruitment capacity refers to an organization’s ability to source, assess, and hire candidates within a particular period—generally a quarter or year. This metric serves as a balancing act between recruiter workload, available recruiting resources, time-to-fill, and the expected volume of open roles. Determining recruitment capacity starts with tracking how many requisitions a recruiter can effectively manage while still maintaining a high standard of candidate experience and diversity of outreach.

Organizational context matters: Seasonal hiring spikes, specialized job requirements, or heavy reliance on passive sourcing may require recalibrating typical recruiter capacity assumptions. For example, a generalist recruiter may handle 25–30 roles simultaneously, while technical or executive recruiters maintain a lower, more focused workload. Transparent communication around these capacity figures helps talent acquisition teams set—and meet—realistic hiring goals.

Calculating Cost Per Hire

The cost per hire is a comprehensive figure that quantifies all expenses involved in hiring a new employee. Industry-accepted formulas, such as:

Cost Per Hire = (Internal Recruiting Costs + External Recruiting Costs) / Total Number of Hires

Internal costs include salaries and benefits for HR staff, in-house recruiter salaries, technology investments, and internal referral bonuses. External recruiting costs cover job board posting fees, agency services, recruitment marketing, background checks, and even travel expenses for candidates or interviewers. The Society for Human Resource Management (SHRM) reports that the average cost per hire in the US hovers near $4,700, although some roles—primarily technical or executive positions—can cost substantially more.

Data-Driven Forecasting Models

The systematic analysis of historical hiring data and predictive modeling fuels modern recruitment capacity planning. Statistical frameworks, such as the Poisson-Gamma model, are being adopted by forward-thinking HR teams to forecast headcount needs and identify trends. These models estimate probabilities of requisitions per recruiter and adjust for volatile markets or changing business directions. Organizations with robust data analytics experience a more substantial alignment between recruitment supply (candidates) and demand (open hires), thereby reducing the likelihood of missed hiring targets or sudden recruitment bottlenecks.

Best Practices for Accurate Forecasting

- Analyze Historical Data: Regularly review prior years’ recruitment metrics—such as time to fill, time to hire, and offer acceptance rates—to identify recurring patterns or areas for improvement.

- Collaborate with Stakeholders: Facilitate conversation between business unit leaders, hiring managers, and recruiting teams to anticipate business growth, reorgs, or project-driven hiring surges.

- Monitor Market Trends: Stay vigilant about macroeconomic shifts, emerging skills shortages, or salary competition. Combining these signals with your benchmarking data enhances recruitment forecasting.

Common Challenges and Solutions

Many companies struggle with inconsistent hiring demands, recruiter turnover, unclear hiring priorities, or tightening recruitment budgets. Some best-in-class solutions for overcoming common hurdles include:

- Implement Flexible Strategies: Deploy agile and scalable recruitment frameworks, such as contract recruiters, RPO models, or on-demand recruiting, to buffer unexpected surges or role freezes.

- Invest in Technology: Utilize applicant tracking systems (ATS), automation, and people analytics tools to speed up decision-making and control per-hire costs.

- Continuous Improvement: Routinely audit recruitment processes and outcomes, applying iterative adjustments so hiring efficiency improves over time.

Research from Gartner indicates that organizations using advanced analytics and integrated TA tools achieve faster fills, lower costs per hire, and higher hiring manager satisfaction rates.

Conclusion

Mastering recruitment capacity forecasting and accurately calculating cost per hire provides a reliable framework for consistent, scalable, and financially responsible hiring. By utilizing statistical models, organizations can more accurately predict future talent needs, thereby reducing guesswork and minimizing delays in filling critical roles. Involving key stakeholders—such as department leaders, HR teams, and finance—helps ensure alignment on goals, budget expectations, and workforce priorities. Continual refinement of data inputs and processes strengthens forecasting accuracy over time. When these practices are integrated effectively, companies can attract and secure qualified candidates exactly when they are needed, manage recruitment expenses responsibly, and build a talent acquisition strategy that supports long-term organizational growth. Click here for more information.